The Background

Combi, a leading Japanese childcare product company, has operated in the Chinese market for years, yet has struggled to boost sales despite offering high-quality products. They approached our team with two key objectives:

Inform New Stroller Design: Deepen understanding of baby stroller usage patterns to improve existing products.

Discover Growth Opportunities: Identify unmet needs and trends to uncover new product lines in China.

The Challenge

Based on the product’s specific usage scenarios and the cultural practices of our target group, I recognized the following two primary challenges:

Baby Strollers Usage Patterns

As baby strollers are used when taking children to various places, selecting the appropriate research methods is crucial to accurately represent the product's usage in real-world scenarios.

Key Decision Maker

In Chinese families, purchasing decisions related to baby products are often made collectively rather than individually. It is crucial to understand the family dynamics to ensure we engage with the right people.

The Methodologies

Considering the above challenges and after negotiating the budget with the clients, we decided to use two methods for this project: in-home visits and shadowing.

In-Home Visits:

By visiting users in their homes, we can gain a comprehensive understanding of the products used around the child. Additionally, it enables us to interact with multiple family members, giving us a deeper understanding of the collective decision-making process that is crucial in Chinese families.

Shadowing:

By following participants as they go about their daily routines, shadowing captures the spontaneous and natural use of the stroller during outings. This method ensures that we see the stroller's performance and usability in various real-world conditions.

Impact

Improvement of the Existing Product

Based on concrete user feedback regarding current stroller usage, the team made timely adjustments before officially launching the upgraded version. This resulted in around 20% increase in orders from childcare product stores.

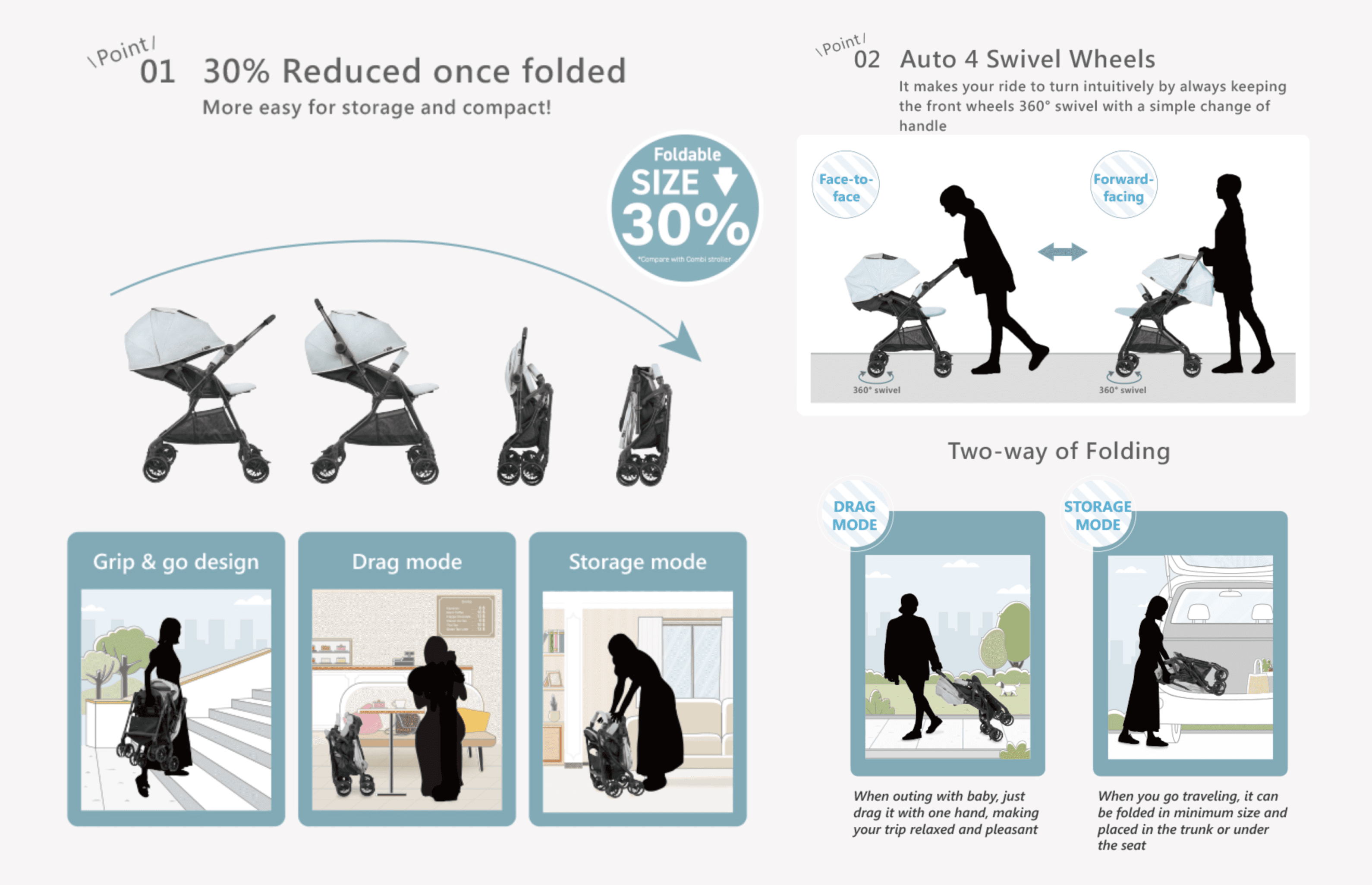

1) More Compact

Through the shadowing sessions, the team gained a deeper understanding of the stroller's usage scenarios, which informed the technical team's decision to upgrade the mechanical system. This enhancement improved the stroller’s foldability, making it more compact, easier to store, and simpler to drag with one hand.

2) More Stable

During our observations of various roads in public spaces, we noticed that moms found it challenging to control the stroller's direction. The new model features improved wheels that make turning easier and more intuitive, regardless of the facing option.

Through the field research and workshop, the client team also uncovered new business opportunities, steering the product lines to form an ecosystem that satisfies unmet user needs. They narrowed down 2 new product directions:

1) Prepare Formula Milk Outside

Unlike in North America, where people can drink directly from tap water, moms in China often struggle to find hot water when traveling outside. There is a need for a solution that helps moms heat water and test its temperature before preparing formula milk.

2) Detect Baby's Bathroom Needs

One of the biggest pain points for new moms is that they can hardly tell when their babies need to pee or poo. This difficulty often leads to discomfort for the baby and increased stress for the moms, potentially resulting in frequent diaper changes and disrupted daily routines. To address this issue, there is a need for a method or device that can help moms detect these signals more effectively.

Timeline

Research Preparation: 3 weeks

Field Research: 2 weeks

Debrief Workshops: 1 week

Final Delivery: 2 weeks

Research Preparation

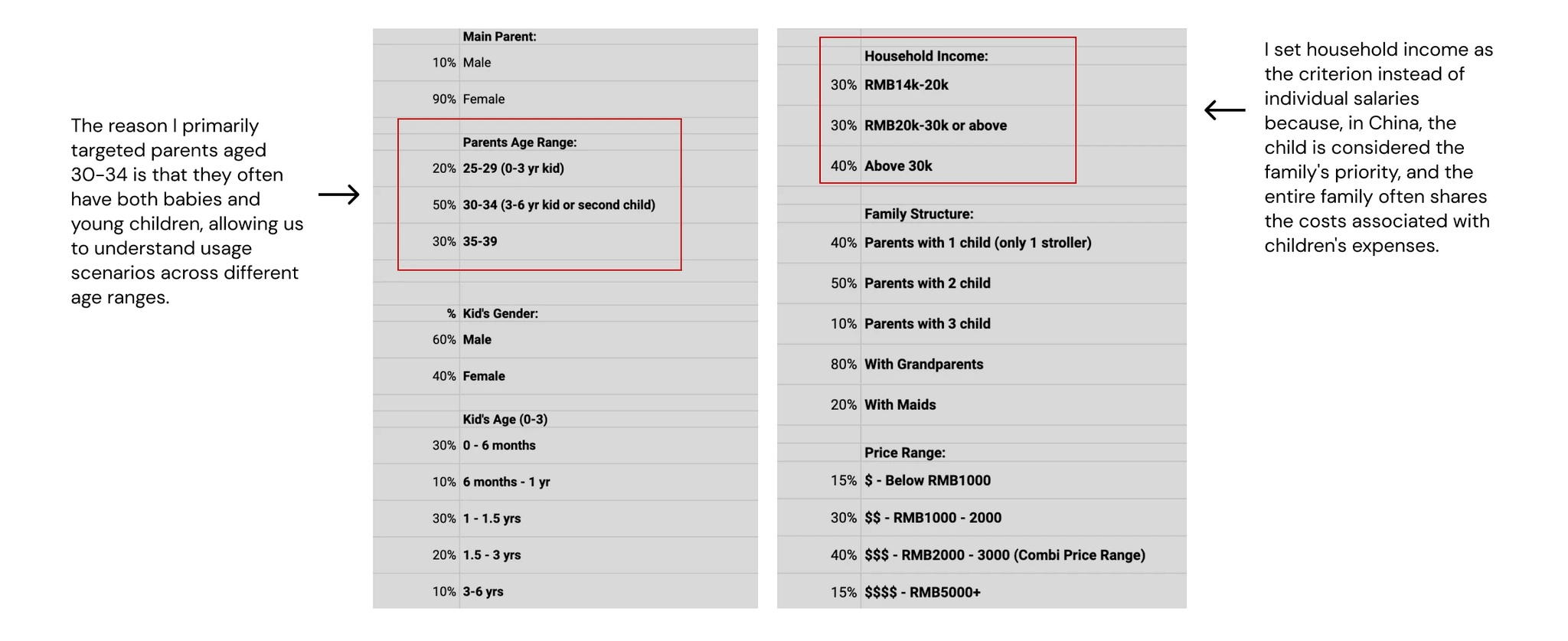

user recruitment

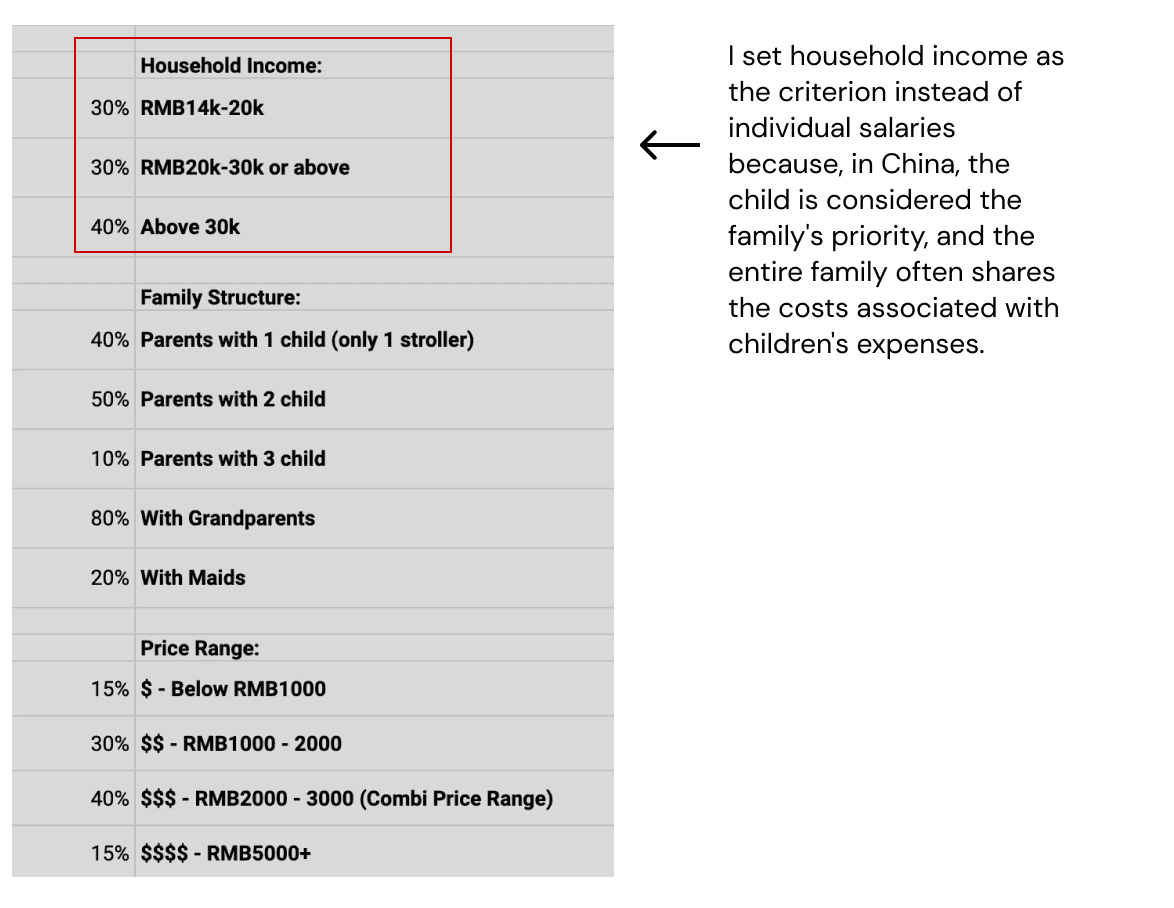

To ensure that our study encompassed diverse perspectives and accurately represented our target market. I used this spreadsheet to document user profiles, which provided the team with a holistic view of the 10 participants.

On the left side of the sheet, I calculated the ratio for each criterion to ensure our sample accurately represents the target market segments.

interview guide

According to the 2 objectives set by the client, I had designed the interview guide to understand users' interactions with childcare products from multiple angles:

1. Daily and Travel Routines: To capture a wide range of usage scenarios and preferences.

2. Product-Specific Insights: Focus on the stroller itself, including purchasing decisions and experiences, to discover unmet needs.

3. Technological Integration and Broader Concerns: Exploring the use of technology and general baby care concerns helps identify new growth opportunities and potential product innovations.

4. Brand Perception: Understand how the brand is perceived relative to competitors. This feedback can guide culturally appropriate branding strategies that resonate better with Chinese consumers.

Field Research

In-Home Visits and Shadowing

Through the in-home visits, the client team had the opportunity to thoroughly observe the users’ living environment and childcare products. As someone born and raised in China, I was able to decode cultural phenomena for the team, helping them better understand how childcare items are integrated into people’s daily life.

In the shadowing sessions, we accompanied users as they went about their regular routines with their children, observing firsthand how the strollers are used in various real-world settings.

store visits

We also added the store visit session to help the client understand the current competitive landscape, including pricing, packaging, and promotional strategies. This insight helps identify gaps and opportunities in the market.

Debrief Workshop

After concluding the field research, I facilitated the team in fleshing out all the insights they had gathered. We conducted an in-depth debrief session to analyze these insights and employed various frameworks to organize, interpret, and communicate our findings effectively.

Final Delivery

Finally, we compiled a comprehensive report consolidating all the research findings, analyses, and recommendations. I was primarily involved in the below sections of the report:

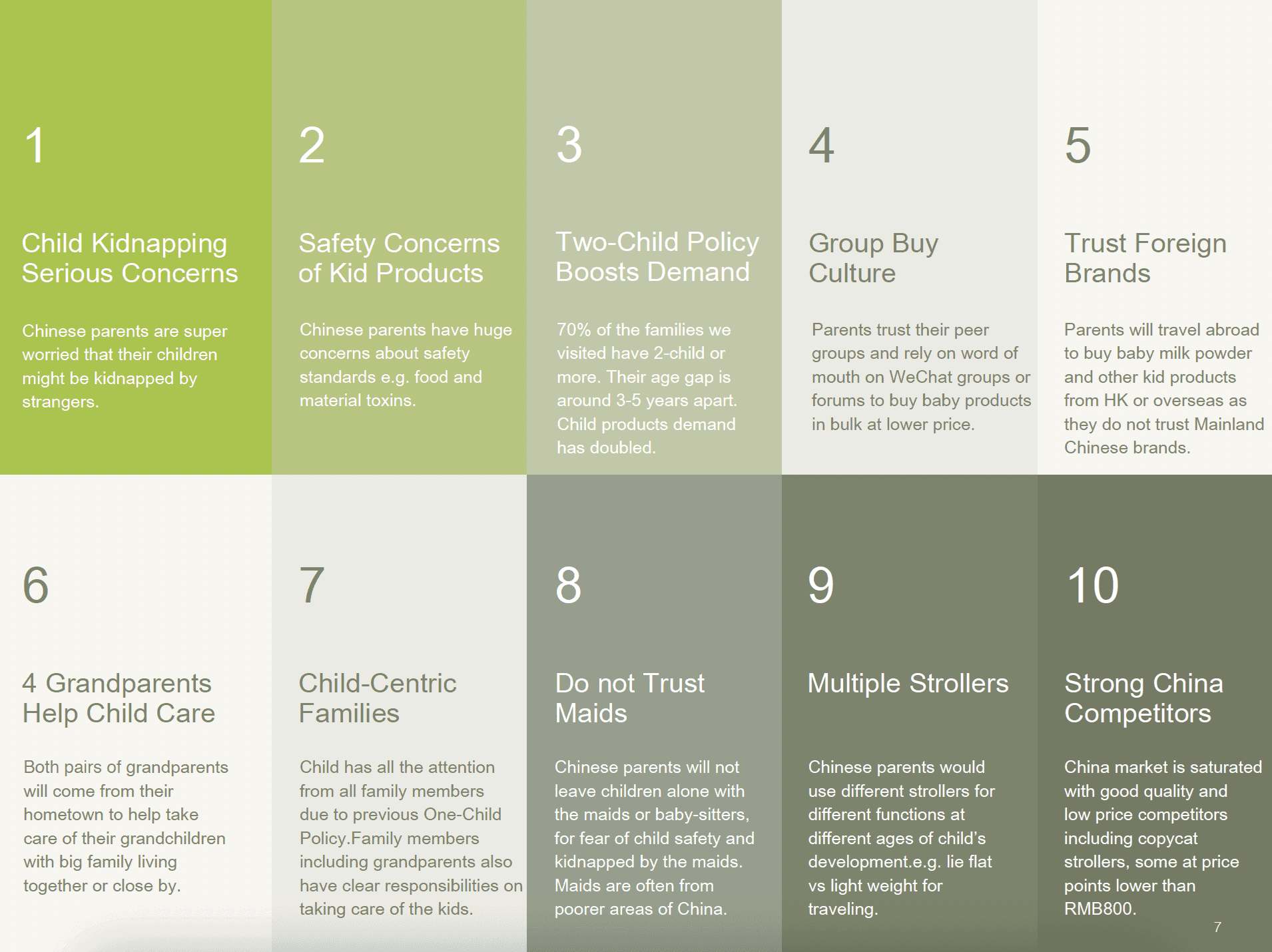

eXECUTIVE SUMMARY

To prepare the summary for C-Level executives, I focused on aligning essential insights with the business goals and project objectives. The summary was consisted of 10 insights:

Top 1&2: Most significant concerns that can be applied to both existing and future products

Top 3 - 8: Culturally-based insights that can inform the client team on how to make the product more relatable to Chinese users.

Top 9&10: Related to products and competitors, providing information on the competitive landscape

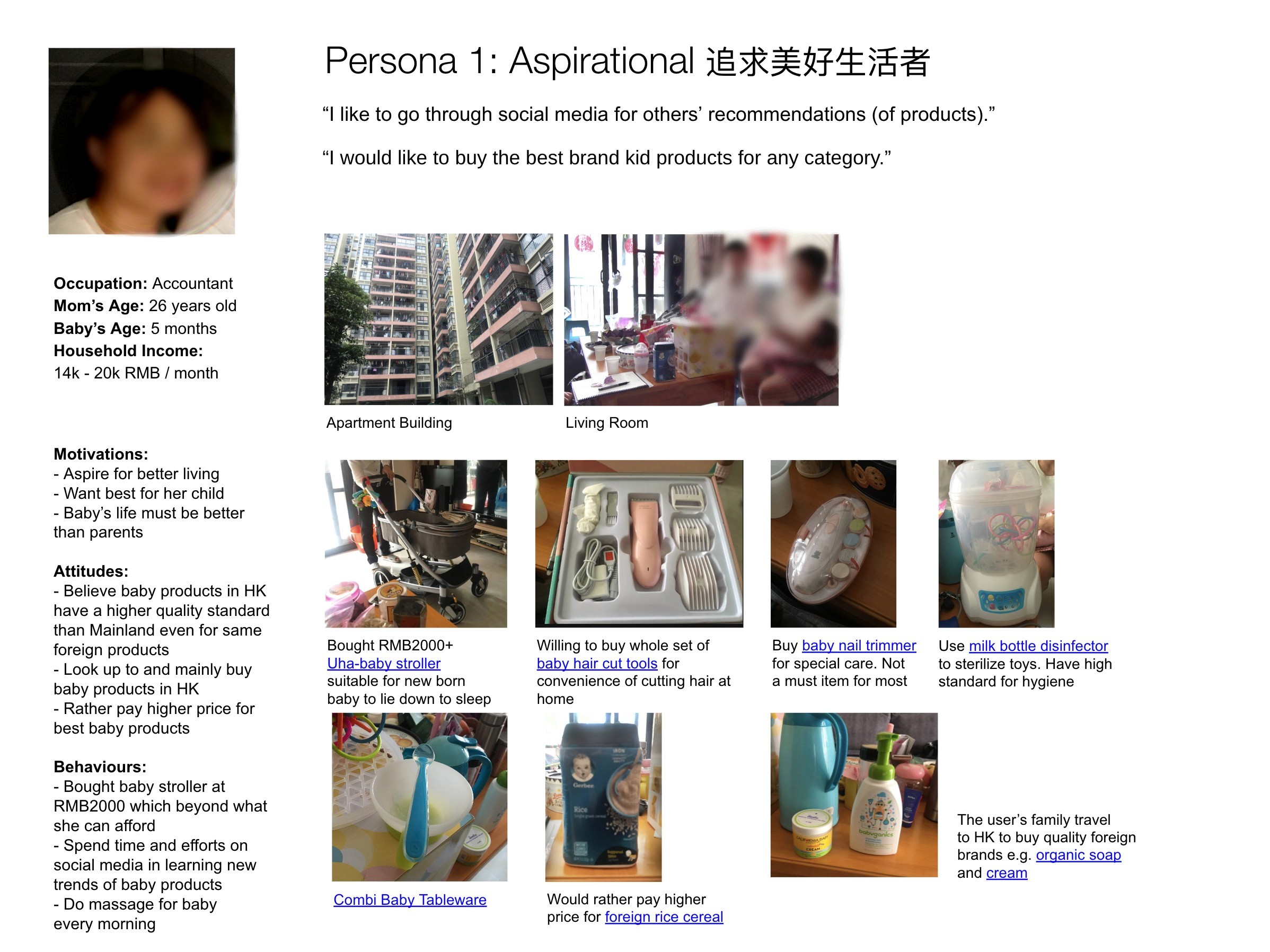

PERSONA

For creating personas, I used narrative storytelling to describe in detail the key aspects of the participants' life situations, goals, and behaviors relevant to the design inquiry. The images supplemented these narratives, adding a compelling impression of the personas' lifestyles, including typical spaces, objects, and activities.

INSIGHTS AND RECOMMENDATIONS:

To further facilitate the design and development team, I collaborated with the team to break down the key findings under the Top 10 insights. By creating detailed pages with insights and user quotes, we provided a clear and actionable framework for understanding user needs and preferences.